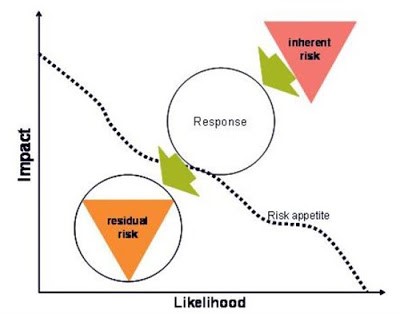

Too often the practice of internal auditing, when performing risk assessments, looks at Inherent Risk (the level of risk before any remediation) and Residual Risk (the level of risk after remediation). This is inadequate and forgets one of the most important aspects of Risk: the Risk Appetite.

Risk Appetite provides management with a view of the level and type of risk that the entity is willing to take, and the risks that the entity will pursue. Missing from the IIA’s (and others) assessment of risk is the Target Risk level. This represents the level of risk acceptable for any individual risk based on the Risk Appetite of the entity.

The delta between Inherent Risk and Residual Risk measures only the current assessed level of control or risk. It does not provide a link to what is the acceptable level of risk (and control) for the entity. This means that Internal Audit could, in theory, report that the entity is well controlled as the Residual Risk level is accurately stated and the controls to enable that level of Residual Risk are functioning effectively.

Equally, in theory, the Residual Risk level could actually be fully in-line with the Risk Appetite, and in such a case there would be no Internal Audit findings other than “(Auditable area) appears to be well controlled with the current Residual Risk being within the Risk Appetite”.

I do say “in theory” because I have only seen one Internal Audit report in the past 35 years that did not contain findings and recommendations, even when reporting that the audited area is effectively controlled. Internal Auditors simply, almost pathologically, count the number of findings, and too few findings are seen (by the Internal Auditors) to indicate a poorly performed or ineffective Internal Auditor. For a candid discussion of the “7 deadly Internal Audit sins” I would only point you to the video from Richard Chambers, IIA President and CEO.

The concept limiting risk to Inherent and Residual is sound – IF that remediation reduces risk to within Risk Appetite.

The reality is that Inherent and Residual Risk scores do not cater for the situation in which the level of residual risk is inconsistent with the entity’s Risk Appetite. This is left to Internal Auditor to attempt to determine what the control environment should include to bring it within the Risk Appetite, sometimes in the absence of a defined Risk Appetite.

In this case, we need to know what the Target Risk score is, in terms of the Risk Appetite. The most important delta then is between the Residual Risk level and the Target Risk level, not between Inherent and Residual.

Of course there is the common problem that many (most?) entities do not have a well-defined Risk Appetite, and therefore it is almost impossible to confirm that a Residual Risk position actually is within the Risk Appetite. This make development and communication of the Risk Appetite a critical step for an entity in its journey to becoming “well controlled”.

Therefore, as the Risk Appetite frequently is either non-existent or not well communicated and understood, the probability is that the Residual Risk position will not be in line with what would be the Risk Appetite. What is needed then is to determine what management considers the “Target” risk position should be for any risk, thus creating the de-facto Risk Appetite at that particular risk level.

Then, with a Target Risk score, it is possible to clearly communicate the difference between the Residual and the Target. That difference is the Internal Audit finding, and can be used to demonstrate the need for improved or additional controls, or can be used to demonstrate that existing control are not operating effectively.

In an ideal world the entity will have a defined Risk Appetite statement, or Target risks scores for each identified risk, therefore having a de-facto Risk Appetite at the risk level. And in such an entity, all Internal Audit findings and recommendations should demonstrate how those recommendation will enable achievement of the Target, and therefore Risk Appetite. This will also allow management to petition an adequately senior authority to “accept” the risk or authorise resources to plug the gap.

Such “acceptance” should of course be in line with the Delegations of Risk Acceptance, but that is a topic of a different article.

This article originally appeared here and has been reproduced with permission.

Find Daniel on LinkedIn, find out more about GRMSi or read more of his articles here.

How FourthLine can help:

FourthLine is working with a number of financial service firms to help them with Operational Resilience enablement and Outsourcing and 3rd-Party Risk Management, through a mixture of end-to-end consulting and resourcing options.